The Leverage Letter

Smarter Tools. Better Credit. Optimal Living.

Your weekly roadmap to funding smarter, flying further, and building a financially fit business.

🚦 YOUR LIFE NOW

You need funding.

You spot solid business card offers.

You apply—one this week, another next month, maybe another later.

It feels cautious and logical.

🚧 YOUR LIFE WITHOUT CHANGE

But each random application racks up hard inquiries, trips issuer rules, and increases your chances of denial.

You start getting rejected for the cards you really want.

Worse—you reduce your credit score and approval odds without even knowing it.

🚀 YOUR LIFE AFTER CHANGE

You batch applications with precision.

You get approved for 3–4 powerful cards in one go.

You spread inquiries across bureaus, stay under 5/24, and maximize your total approved funding.

That’s leverage.

🛑 Why Random Card Applications Cost You

Too Many Hard Inquiries

Every application triggers a credit pull.

One or two? No problem.

Spread out over months? You rack up red flags.

Each pull might only cost a few points—but together, they compound.

Triggering Issuer Rules

Chase 5/24: 5+ cards in 24 months = likely auto-denied, even with great credit.

Amex & CapOne: Too many inquiries/accounts in a short window? They’ll hit the brakes.

Missed Opportunity for Combined Pulls

Some issuers combine hard pulls if you apply for two cards the same day.

Space them out? Multiple pulls.

Batch them? Fewer hits.

Poor Targeting

Each lender typically pulls from a different reporting agency (TransUnion, Experian, Equifax)—but it varies by state.

Strategic batching lets you spread inquiries smartly.

Random apps? You might hit the same bureau 3x in a row.

Less Total Credit

Denials = lost credit lines.

You could’ve had $60K across 3 cards… but ended up with $20K on one.

That’s missed leverage.

🎯 The Strategic Solution: App-O-Rama Done Right

Step 1: Know Your Profile

FICO scores (all 3 agencies)

Chase 5/24 status

Recent inquiries

Utilization (<10%)

Any reporting business cards

Step 2: Choose 2–4 Cards

Align with your goals (0% APR, rewards, points)

Sequence: Start with issuers most likely to deny (e.g., Chase), save Amex/CapOne for later

Step 3: Research Likely Credit Pulls

Use Doctor of Credit or MyFICO Forums to map which bureau each issuer pulls in your state

Step 4: Apply in a Short Window

Same day is best, 1–2 days max

Step 5: Understand What Reports Where

Chase Biz & Amex Biz typically don’t report (unless you default)

Others (like CapOne) might—so time carefully

Step 6: Be Ready for Reconsideration

If denied/pending: call recon line, be polite, explain your business use

Step 7: Garden for 3–6 Months

After your batch: STOP applying

Let new accounts age, inquiries fade, limits increase

📊 Case Study: Stack vs. Spree

Chris applied randomly:

Chase Ink in Jan (Approved)

Amex Biz Gold in March (Approved)

CapOne Spark in April (Denied)

Another Chase in May (Denied—now over 5/24)

Result: 2 approvals, 2 denials, 4+ inquiries, locked out of Chase.

Priya batched her apps:

Under 5/24, wanted Chase + Amex

Applied same day (Chase pulled Experian, Amex pulled TransUnion)

Approved for both

No card reported to personal

Still under 5/24

Now gardening

Result: Maximum approvals. Minimum impact. Clean path to next funding round.

✅ Action Step This Weekend

🧾 Check your current hard inquiries using Credit Karma or CreditWise.

How many in the last 6 months? Last 24 months?

Are you under 5/24?

This is your baseline. Never apply again without knowing it.

→ Hit reply: Do you usually batch your applications, or apply as offers show up?

→ What’s your biggest credit card win or mistake? Share your story!

✈️ Award Booking Spotlight

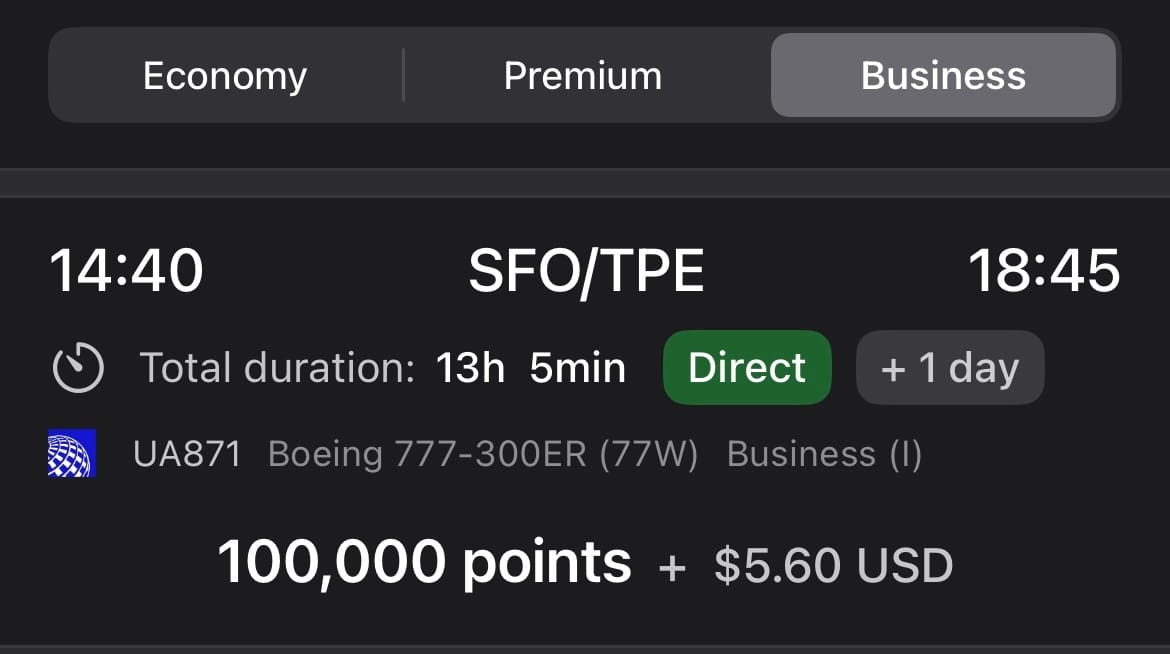

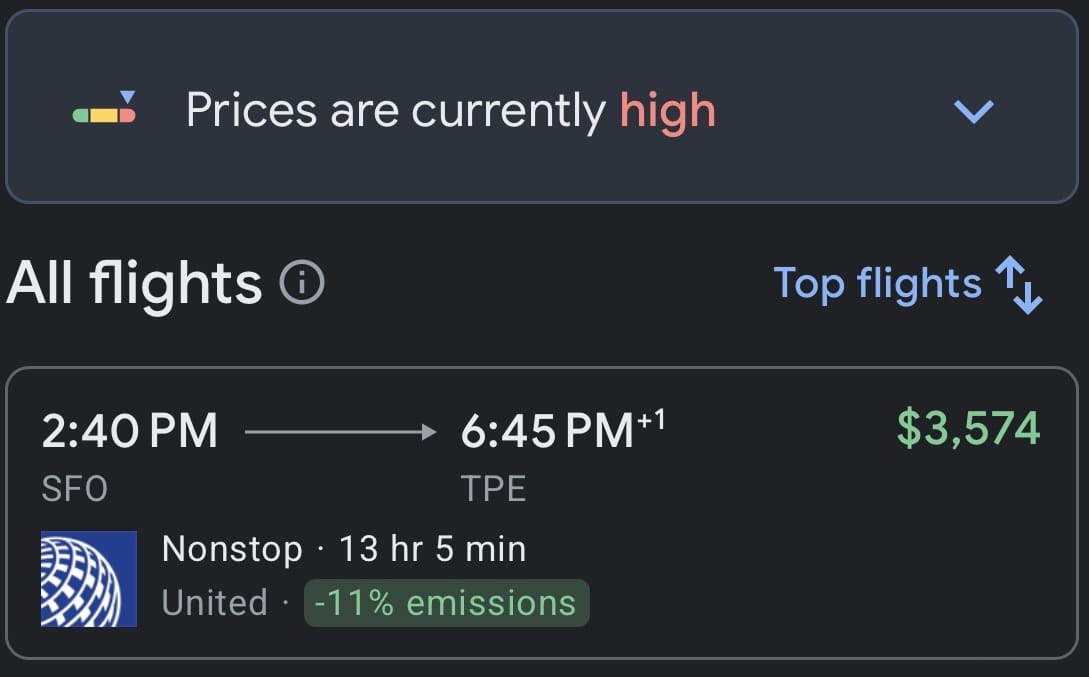

San Francisco (SFO) → Taipei (TPE) in United Polaris Class

Cash Price: $3,574

Paid: $5.60 in taxes

Strategy: Strategic spend + Chase Ink Card bonus

How you book matters; learn to book your flights with points.

Booking with Cash

Thinking about applying soon?

Make sure your business credit foundation is solid first.

To smarter funding and better approvals,

Ade O.

Chief Leverage Officer

Helping entrepreneurs unlock credit, fly free, and live on their terms.