The Leverage Letter

Smarter Tools. Better Credit. Optimal Living.

Your no-nonsense friend helping you leverage credit for your business, travel, and life!

YOUR LIFE NOW:

You’ve banked with Chase, BofA, or Wells Fargo for years.

Feels familiar. Easy. "They know me."

You figure, why change?

YOUR LIFE WITHOUT CHANGE:

You apply for a loan.

You get denied—or lowballed. No explanation. Just:

“Computer says no.”

Meanwhile, you had a strong business plan. Good cash flow. Great potential.

But the big bank didn’t see you. They saw a score.

YOUR LIFE AFTER CHANGE:

You diversify.

You build relationships with a local bank or credit union.

When it’s time to borrow, you have options.

One of them sees you—not just your numbers—and says yes.

WHY BIG BANKS MIGHT BE LIMITING YOUR GROWTH

Big banks aren’t bad—but they’re not built for nuance. And nuance matters.

Rigid Algorithms

Big banks rely on automated underwriting.

If your credit score or revenue doesn’t fit the model, it’s a “no”—even if your business is thriving.You're Just a Number

Unless you’re moving millions, relationship managers have limited pull.

At small banks, your local banker can be the decision-maker—or at least influence them.Less Competitive Terms

Big brands mean they don’t have to fight for your business.

Local banks and credit unions often offer better rates and terms to win clients.No Room for Story

Big banks don’t care about your market, your pivot, or your vision.

Local institutions do. They’ll hear your context—and that can make all the difference.One-Size-Fits-All Products

Need something specialized? Big banks push what they’ve got.

Community banks might be willing to customize.They Don’t Know Your Market

Big banks think national.

Local banks understand your local economy—and lend accordingly.

DIVERSIFY YOUR BANKING

This isn’t about ditching your big bank. It’s about expanding your leverage.

1: Keep Your Primary Big Bank

Yes, keep that Chase or Amex account—especially for their great credit cards, rewards programs, and national tools.

2: Open A Local Account

Pick one of each if possible:

Community Bank: Local decision-makers. Relationship-focused.

Credit Union: Member-owned. Often lower rates, higher approval odds.

Search: “community bank [your city]” or “credit union business account [your city]”

3: Build the Relationship

Don’t just open an account—show up.

Meet the business banker or branch manager

Share your goals and how your business supports the local economy

Use the account consistently (even moderate activity matters)

Check in every 6 months—before you need funding

4: Apply at Both

When seeking business funding:

Apply with your big bank and your local institution.

Compare rates, terms, and flexibility.

You might be shocked where the better deal comes from.

5: Ask About Local Programs

Local banks often have access to unique SBA initiatives, microloans, or community grant programs that big banks don’t advertise.

Ask directly:

“Do you offer any small business funding programs specific to [city/state] businesses?”

CASE STUDY: The Credit Union Yes

Elena, a catering business owner, needed $75K for new equipment.

Her long-time big bank? Rejected her—she hadn’t been in business long enough.

She remembered she’d opened a business account at a credit union nearby.

She booked a meeting, brought a business plan, and showed local contracts.

Result: Approved for the full $75K—at a competitive rate.

The big bank said no. The local bank said yes—because she built the relationship early.

ACTION STEP

Identify one local community bank or credit union in your area.

Spend 15 minutes on their website:

Do they focus on small businesses?

What kind of business accounts or funding products do they offer?

Consider stopping by next week to ask about opening a basic account—no pressure, just a conversation.

→ Hit reply: Do you currently have a banking relationship with a local institution, in addition to your big bank?

Yes or No?

AWARD BOOKING SPOTLIGHT

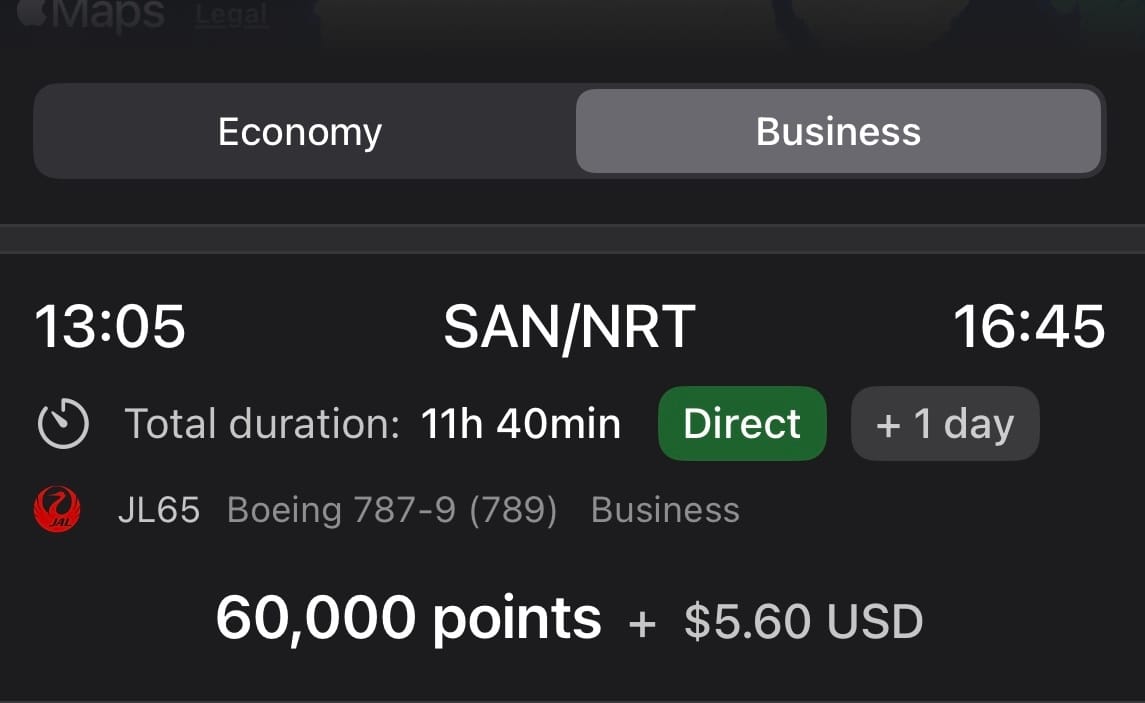

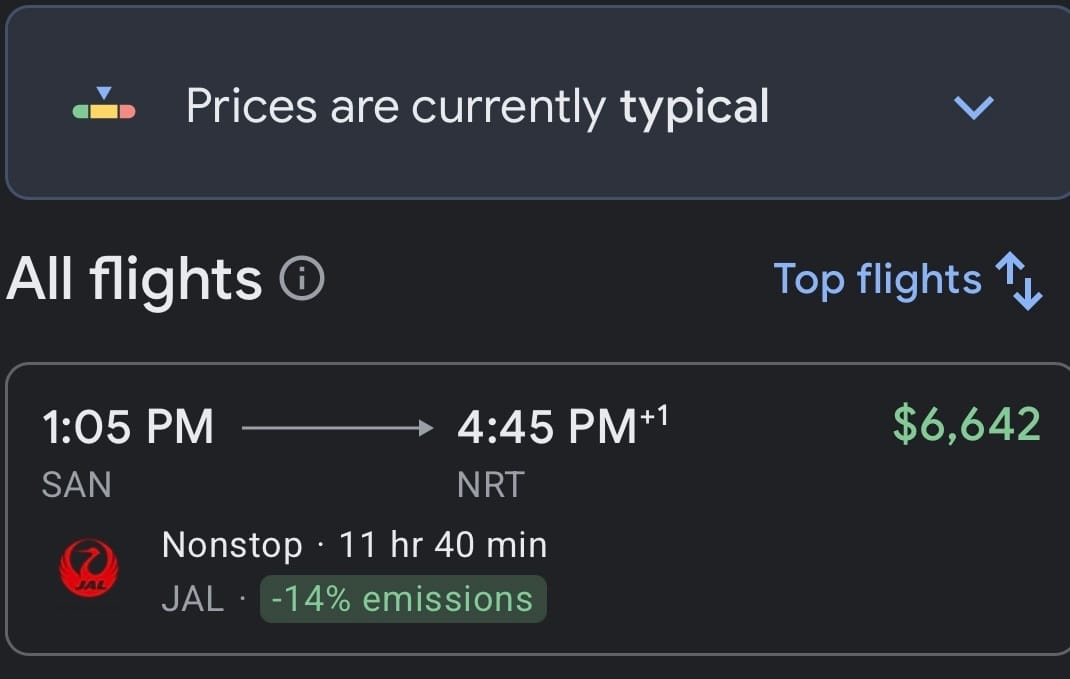

San Diego → Tokyo in Japan Airlines Business Class

Points Used: 60,000 miles + $5.60

Cash Price: $6,642

Booking with Cash

Pro tip: Smart points strategy > cash, every time.

Learn to book your flights with points.

P.S. Banking relationships build leverage over time.

Start early, start NOW. Grow intentionally.

To smarter banking and better funding,

Ade O.

Chief Leverage Officer

Helping entrepreneurs build credit, unlock capital, and optimize their business like pros.