The Leverage Letter

Smarter Tools. Better Credit. Optimal Living.

Your weekly playbook for funding your business, flying for free, and building financial leverage that lasts.

YOUR LIFE NOW:

You’re running your business, focused on sales, maybe using personal cards for expenses.

You think, “I’ll worry about business credit later.”

YOUR LIFE WITHOUT CHANGE:

Later turns into too late—when you need $100K in funding and get denied.

Your business credit file is thin. Lenders demand a personal guarantee.

You’re stuck with low limits, high interest, and zero negotiating power.

YOUR LIFE AFTER CHANGE:

You build a real business credit profile—deliberately.

Banks trust your EIN. You qualify for bigger lines, better rates, and more options—without putting your personal credit on the line.

Leverage becomes your tool, not your liability.

Let’s stop waiting—and start building.

WHY DELAYING BUSINESS CREDIT BUILDING KILLS GROWTH

Business credit doesn’t build itself.

It’s not like personal credit that grows automatically.

You have to take specific actions—and the earlier, the better.

Time is Your Ally (Until You Waste It)

Lenders want to see history—at least 6–24 months of positive payments tied to your EIN.

Start late, and you’re stuck waiting longer when it matters most.

Higher Limits Come With Time

Established business credit can unlock 5–10x higher limits than personal cards.

Wait to start, and you’re left with tiny limits that don’t support real growth.

Delayed Start = More Personal Guarantees

Lack of business credit = PGs required.

The only way to reduce personal exposure is to grow your business’s own credibility.

No file = no trust.

Worse Loan Terms, Higher Costs

Strong business credit unlocks lower interest rates, longer repayment terms, and better offers.

Thin file = risk. And risk means you pay more.

No File = No Funding

Many lenders—especially for SBA loans, equipment financing, and larger lines—won’t touch you without solid business credit reports.

No PAYDEX, no deal.

No Separation = No Legitimacy

A clean business credit file signals professionalism, structure, and legitimacy.

It shows you treat your business like a business—not a side hustle.

THE LEVERAGED ACTION PLAN: BUILD YOUR BUSINESS CREDIT NOW

No more delays. Here’s how to start:

STEP 1: Get Your Foundation Right

You must have:

A legal entity (LLC or S-Corp)

An EIN from the IRS

A dedicated business bank account

If you’re missing any of these—start here. You’re not ready to build credit without them.

STEP 2: Open Accounts That Report

Get business credit flowing by using accounts that report to business bureaus (Dun & Bradstreet, Experian Business, Equifax Business).

Start with:

Business Credit Cards: Amex and Chase cards often report to business bureaus.

Loans or Financing: Make sure they report! Not all lenders do.

STEP 3: Pay Early, Not Just On Time

PAYDEX loves early payers.

Aim to pay your bills 10–20 days before they’re due.

That’s the fast lane to an 80+ PAYDEX score.

Also: keep balances low on revolving lines.

STEP 4: Monitor Your Business Credit

You can’t fix what you can’t see.

Use tools like Nav or Experian Business to monitor your reports.

Look for errors. Track your score.

Dispute inaccuracies fast.

STEP 5: Keep Your Info Consistent

Business name, address, and contact info must match across all platforms—bank, IRS, credit bureaus, secretary of state filings.

Inconsistencies cause reporting issues (and missed opportunities).

CASE STUDY: The Tale of Two Startups

Startup A: Waited Too Long

They ran for 2 years using only personal cards. When they finally applied for a $150K loan, lenders said:

“No business credit history = high risk.”

They only got $50K—with a PG and a high interest rate. Growth plans stalled.

Startup B: Built Early

They registered, opened a business bank account, got two business cards, and used them for everything.

They paid early. They monitored reports.

Two years later, they also needed $150K.

Their PAYDEX and Intelliscore were solid. They got approved for $125K—no PG required.

Same business need. Very different result.

ACTION STEP THIS WEEKEND

Check your business credit:

→ Sign up for a free account at Nav.com.

→ Look at your business credit file.

Ask yourself:

→ Do you have any scores reporting?

→ Are there any errors?

→ What’s one step you can take this weekend to improve it?

→ Hit reply: On a scale from 1 to 10, how focused have you been on building your business credit? (1 = Not started, 10 = All-in and monitoring regularly)

AWARD BOOKING SPOTLIGHT

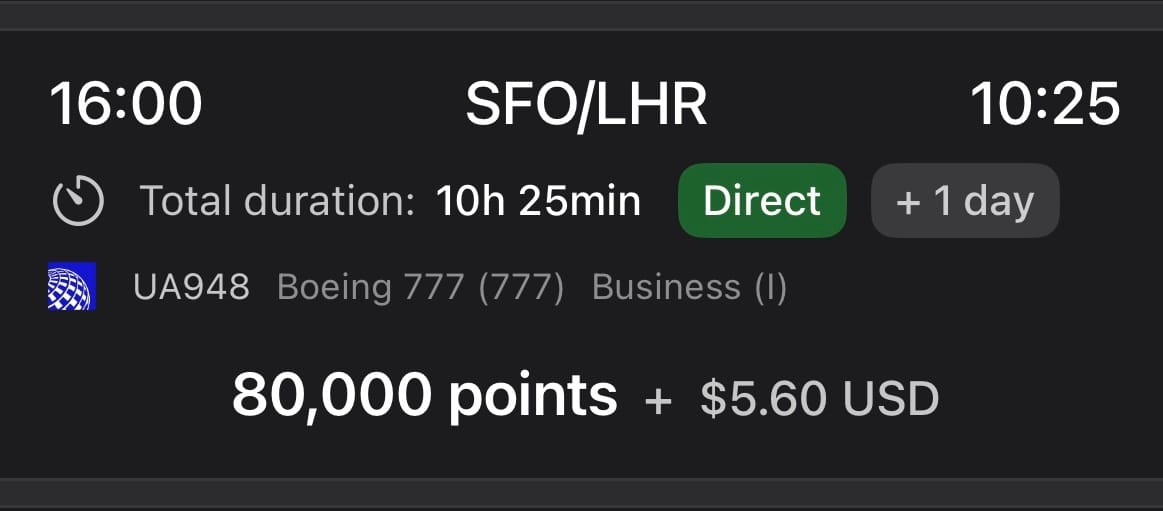

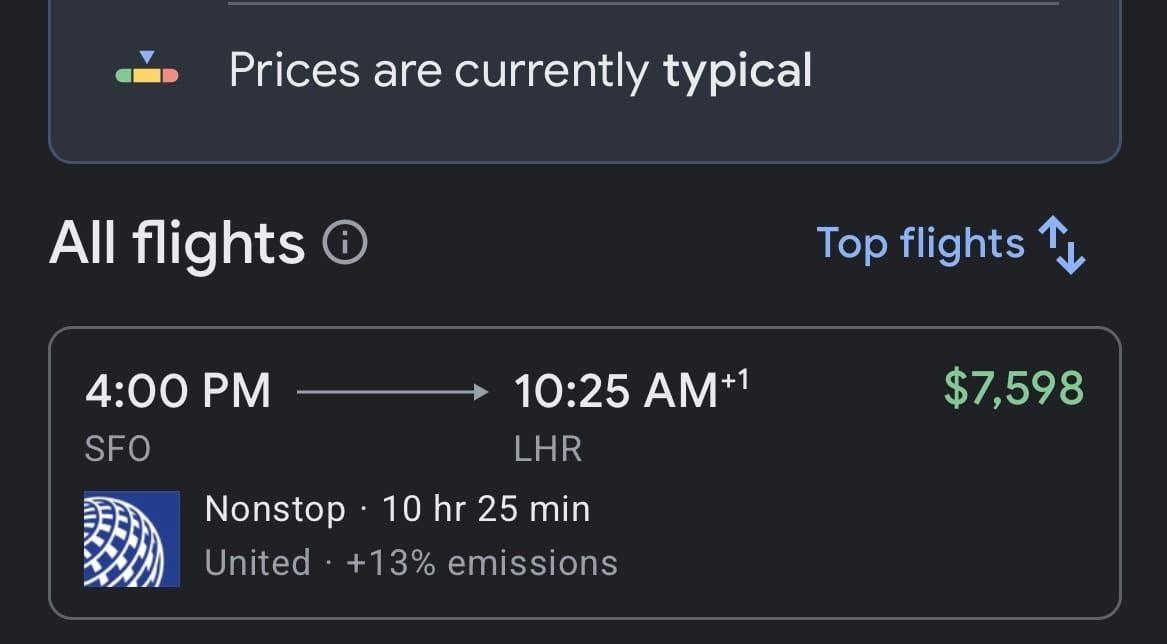

San Francisco → London in United Business Class

Points Used: 80,000 Chase UR Points → United MileagePlus

Cash Price: $7,598

Paid: $5.60 in taxes

Strategy: Earned via Chase Ink Preferred

Booking with Cash

Luxury travel, funded by smart credit—not out-of-pocket cash.

P.S. Building your business credit profile is one of the highest ROI activities you can do.

To bigger funding, lower risk, and smarter leverage,

Ade O.

Chief Leverage Officer

Helping you optimize credit, grow your business, and fund your life—on your terms.