The Leverage Letter

Smarter Tools. Better Credit. Optimal Living.

Your weekly guide to funding your business, flying for free, and staying financially sharp.

YOUR LIFE NOW:

You see it everywhere:

“0% APR for 12–18 months!”

It feels like free money.

You grab the offer, fund a project, breathe easier. Growth, no interest. What’s not to love?

YOUR LIFE WITHOUT CHANGE:

Then—boom. The promo ends.

You still owe thousands. Interest jumps to 22%. Minimum payment spikes. Your cash flow tightens overnight.

Suddenly, that “free” money turns into an expensive trap—and your profits start bleeding.

YOUR LIFE AFTER CHANGE:

You use 0% APR like a pro—only for smart investments.

You set a repayment plan. You pay it off before the promo ends.

You keep control. You keep leverage.

Here’s how to do it right.

WHY 0% APR OFFERS BECOME DEBT TRAPS

They look like the ultimate growth tool—but without discipline, they become financial landmines.

Payment Shock

When the promo ends, the interest rate spikes—often to 18–25%.

If you still carry a balance, your minimum payment jumps.

Cash flow gets squeezed. Profits vanish.

Deferred Interest Danger

Some cards (especially retail/store cards) don’t waive interest—they defer it.

Miss the deadline by even $1 and you owe all the interest from day one.

Read the fine print. Look for “waived interest,” not “deferred.”

Overspending Psychology

“0% interest” makes it easy to buy more than you need.

You justify that extra software or ad spend because “it’s not costing me anything right now.”

Then you’re left with a mountain of debt and no plan.

Minimum Payment Trap

Paying the minimum means the balance stays high.

When the 0% ends, you’re hit with massive interest on a big number.

Minimums are designed to keep you in debt.

Forgetting the End Date

Busy life = missed deadlines.

That one overlooked statement cycle?

Could cost you hundreds—or thousands—in sudden interest charges.

USE 0% APR STRATEGICALLY

These offers can be gold—but only if you treat them like a loan, not a loophole.

RULE #1: Start With a Specific Plan

Don’t use 0% APR for random spending.

Use it for:

Inventory with clear ROI

Equipment you need now

A launch with predictable cash flow return

Then do this:

[Total Spend] ÷ [Promo Months - 1] = Monthly Payment Goal

Set that number. Stick to it.

RULE #2: Automate the Payments

Don’t rely on memory.

Set auto-pay from your business account for your calculated monthly payment.

Treat it like a business loan—because it is.

RULE #3: Track the Expiration Date

Put the 0% APR end date on your calendar.

Set reminders: 60 days before, 30 days, and 2 weeks.

Missing this date = big trouble.

RULE #4: Freeze Spending Near the End

Stop using the card for new expenses in the last 2–3 months of the promo.

Focus on paying it down. Don’t risk carrying over a new balance into high-interest territory.

RULE #5: Prioritize High-Interest Debt First

Don’t overpay the 0% balance if you have other debt at 15–30%.

Stick to the repayment plan—and attack the expensive debt first.

RULE #6: Know the "Go-To" Rate

What happens when the promo ends?

Is it 19%, 21%, or 24%?

Knowing that number keeps you honest—and motivates timely repayment.

CASE STUDY: THE $15K Contrast

Chloe needed $12K for inventory.

She got a 12-month 0% card.

She set auto-pay at $1,100/month. Inventory sold well. She paid it off a month early.

Total interest paid: $0.

Ben got the same card.

Put $12K on inventory—and $5K more on “stuff he’d been eyeing.”

Paid only minimums (~$200/month).

At month 13, he still owed ~$15K—and now it was racking up 21% interest.

His monthly payment jumped, and the debt started choking cash flow.

Same offer. Different strategy. Different outcomes.

ACTION STEP THIS WEEKEND

Do you have any 0% APR business cards open?

If yes, do this now:

Find the promo end date.

Divide your current balance by the number of months left.

Ask: Is that what you’re currently paying monthly?

If not—adjust now.

→ Hit reply: Have you ever been surprised by a 0% promo ending early (or hitting you with interest)?

Yes or No?

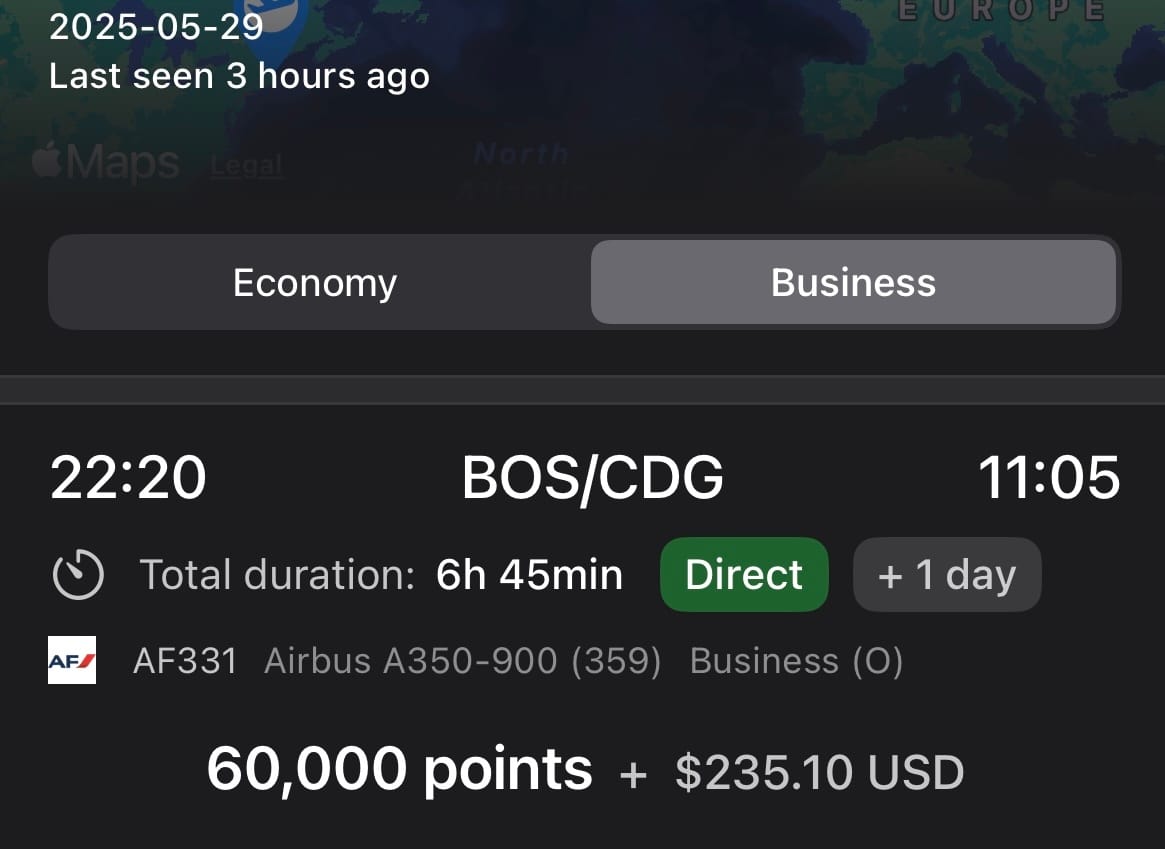

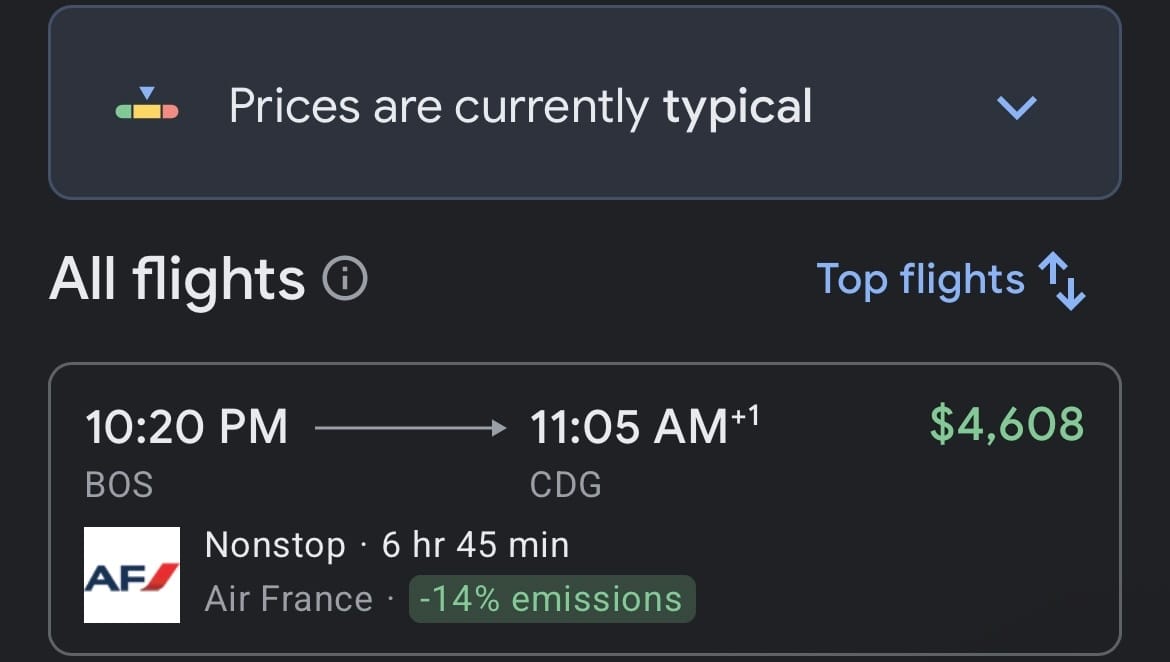

AWARD BOOKING SPOTLIGHT

Boston → Paris in Business Class

Points Used: 60,000 Flying Blue Miles + $236 taxes

Cash Price: $4,608

Booked with: Capital One Miles → Transferred to Flying Blue

Booking with Cash

A low-interest balance didn’t pay for this trip. Smart points did.

Book your travel using points.

P.S. Want to make sure you’re ready to use 0% APR offers without risk?

Start with the [Business Credit Foundation Checklist]—free for subscribers.

To smarter leverage,

Ade O.

Chief Leverage Officer

Helping high-performers fund smarter, fly better, and build optimal lives.

Before You Go: