The Leverage Letter

Smarter Tools. Better Credit. Optimal Living.

Your weekly guide to leveraging credit for your business, travel, and making smarter money moves.

YOUR LIFE NOW:

You’re racking up points on every business purchase-ads, software, inventory. Your balance climbs: 100K… 200K…

You picture first-class flights, five-star stays.

YOUR LIFE WITHOUT CHANGE:

But if you’re earning the wrong points, you might never get that luxury trip.

Wrong ecosystem = wasted value.

And your dream of premium travel? Delayed-or dead.

YOUR LIFE AFTER CHANGE:

You pick the right card for your spend. You understand your points. You book $10,000+ business class trips with ease.

Your rewards finally match your effort.

WHY CHOOSING THE WRONG POINTS KILLS LEVERAGE

All points are not created equal. Here’s where most people go wrong:

Cashback vs. Transferable Points

Cashback is simple-but capped.

100K points = $1,000. That’s it.

With transferable points like Amex, Chase, Capital One, or Bilt, 100K can be $5,000+ in travel-especially for business class flights.

Choosing cashback when your dream is luxury travel is like choosing a piggy bank over a portfolio.

Airline/Hotel Lock-In Risk

Earning points directly with one airline or hotel chain might feel loyal-but it limits flexibility.

Programs change. Devaluations happen.

With transferable points, you can move your rewards to dozens of airlines and hotels when you’re ready-wherever the best deal is.

Missed Transfer Bonuses

Amex, Chase, and others often run transfer bonuses (e.g., +30% to British Airways).

These boosts can mean an extra $1,000+ in flight value.

Locked into cashback or single-brand cards? You miss out completely.

Bad Match for Spending Categories

Each ecosystem shines in different areas:

Amex → flights, restaurants, software

Chase → dining, travel

Capital One → catch-all 2x everywhere

Pick wrong, and you’re earning fewer points for the same spend.

STRATEGY FOR PICKING THE RIGHT POINTS

Let’s align your goals with the right ecosystem:

1: Define Your Redemption Goal

A. Premium Travel (Business Class, 5-Star Hotels)

→ Go with transferable points (Amex MR, Chase UR, CapOne Miles, Bilt).

This is where the big wins live.

B. Simplicity or Domestic Flights

→ Transferable points still work, especially to programs like Hyatt or JetBlue.

Or use cashback if you don’t want to deal with transfers (just know the tradeoff).

C. Maximum Simplicity (Cash Back Only)

→ Use 2%+ cashback cards. You’re trading convenience for potential value.

2: Analyze Where You Spend Most

Ads, Software, Travel, Contractors?

→ Consider: Amex Business Gold, Amex Platinum, Chase Ink Preferred

General Spend Across Categories?

→ Try: Amex Blue Business Plus (2x MR up to $50K/year) or Capital One Spark Miles (2x everywhere)

3: Consider Airline/Hotel Preferences (Lightly)

Love United or Hyatt? → Chase UR

Frequent Delta or Air Canada? → Amex MR or Bilt

International explorer? → Capital One gives unique partner access

Don’t over-optimize here. Use preferences as a tie-breaker.

4: Pick ONE Ecosystem to Start

Don’t chase every shiny offer.

Build momentum in one place-then diversify later.

Start with:

→ Amex MR if you travel international

→ Chase UR if you want flexible U.S. travel and Hyatt/United access

→ CapOne for simple 2x earning and versatile partners

5: Understand Transfer Partners

You don’t need to memorize them-just know the concept.

Amex MR points can become Delta miles, Avianca miles, or Hilton points.

Chase UR points can become Hyatt nights, United flights, or more.

The more you understand, the more value you unlock.

REALITY CHECK: THE CASHBACK REGRET

Michael ran a consultancy.

He put everything on a 2% cashback card, earning $4,000 back over three years.

Nice, right?

But: He also paid $3K+ per trip for international client work-in economy.

Had he used Amex Gold/Platinum, he would’ve earned ~400,000 points.

With transfers, that could’ve covered 2 business class round-trips ($16K–$30K value).

Michael’s “simple” system cost him thousands in unrealized travel value.

For business owners: Try out LeverAged Calculator here.

ACTION STEP THIS WEEKEND

Look at your primary business credit card.

Ask: Does it earn cashback, airline miles, or transferable points?

Does this align with your redemption (business class, luxury hotel, cash)?

If not-it’s time for change.

→ Hit reply: What’s your points goal right now?

(A) Cash Back

(B) Economy Travel

(C) Business Class

(D) Luxury Hotel Stays

AWARD BOOKING SPOTLIGHT

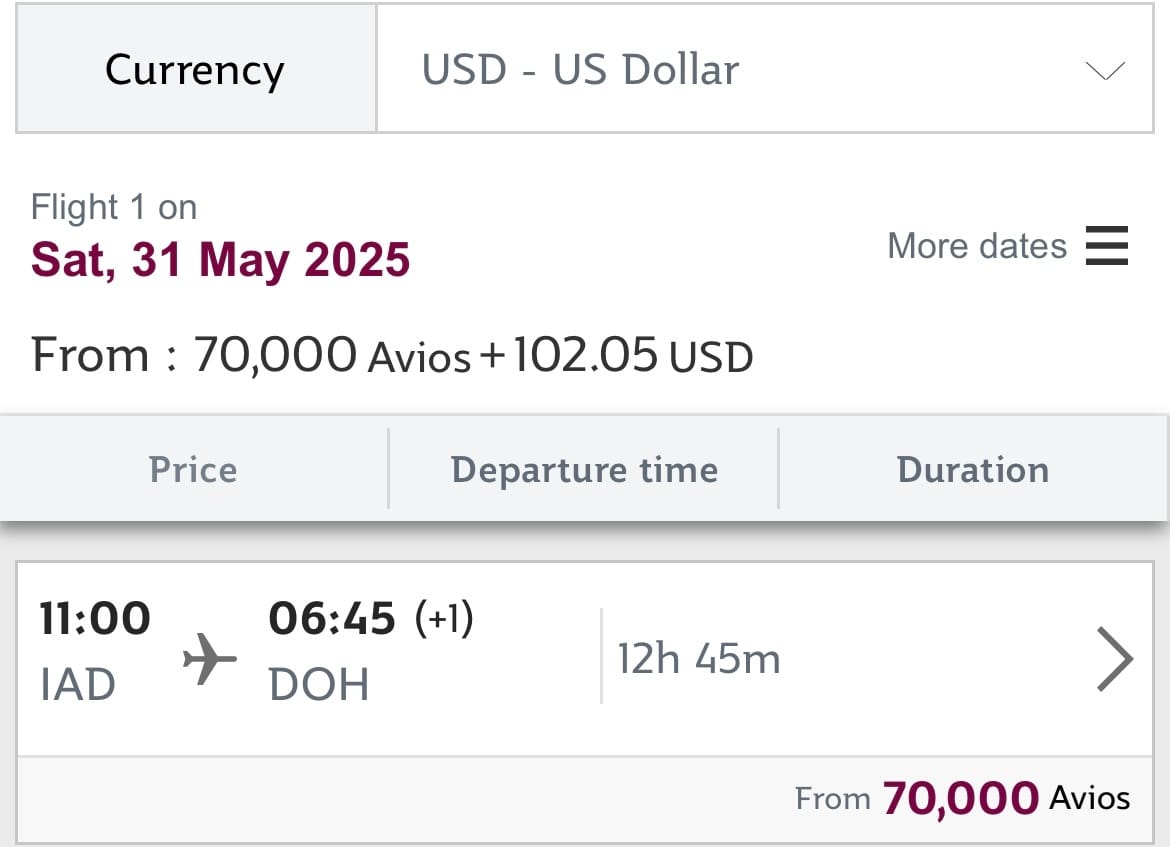

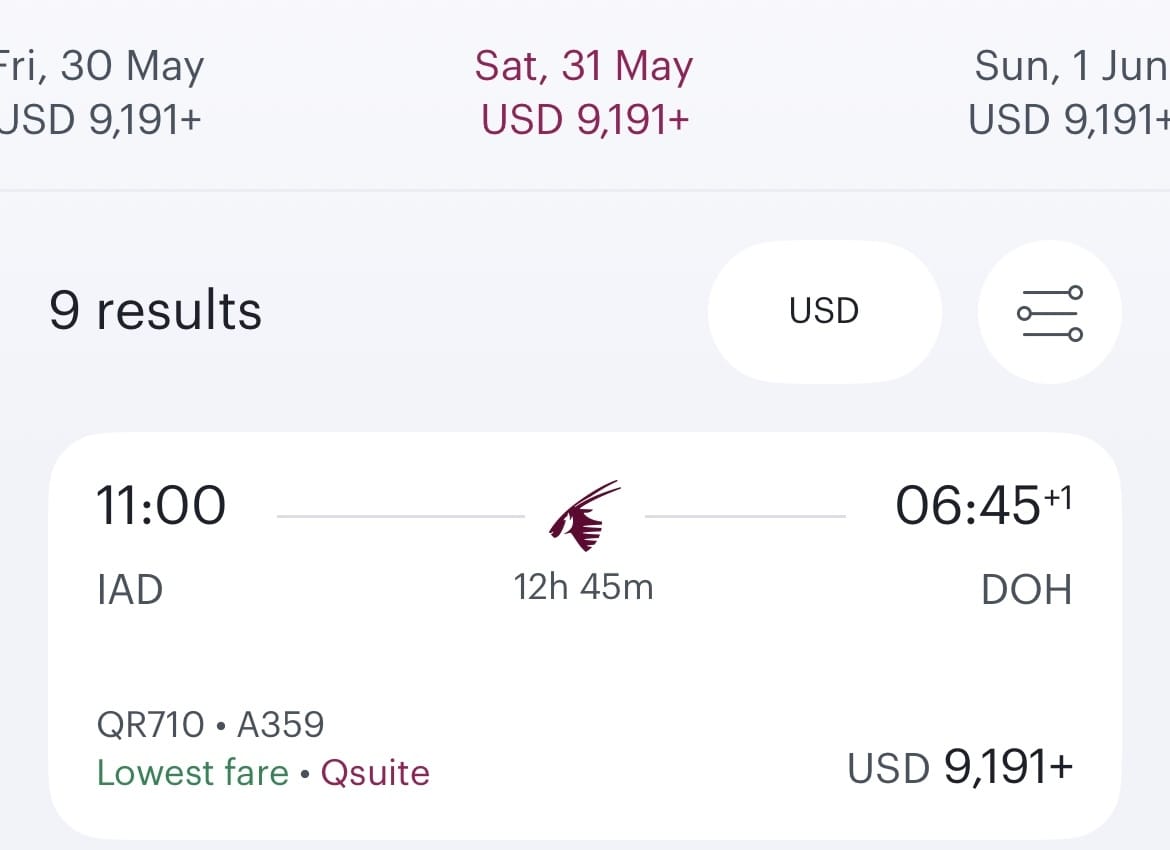

IAD → Doha in Qatar Airways Business Class

Points Used: 70,000 miles + $103 in taxes

Cash Price: $9,191

Booked with Amex points → Transferred to Avios

Booking with Cash

Big seat. Better sleep.

P.S. Want help picking the right points ecosystem for your goals?

To choosing smarter and flying further,

Ade O.

Chief Leverage Officer

Helping you optimize your business, credit, and life-one leveraged move at a time.

Before You Go: